Retrospective Home Appraisals for Estate and Tax Purposes in Ontario

- Laura Cade

- 2 hours ago

- 5 min read

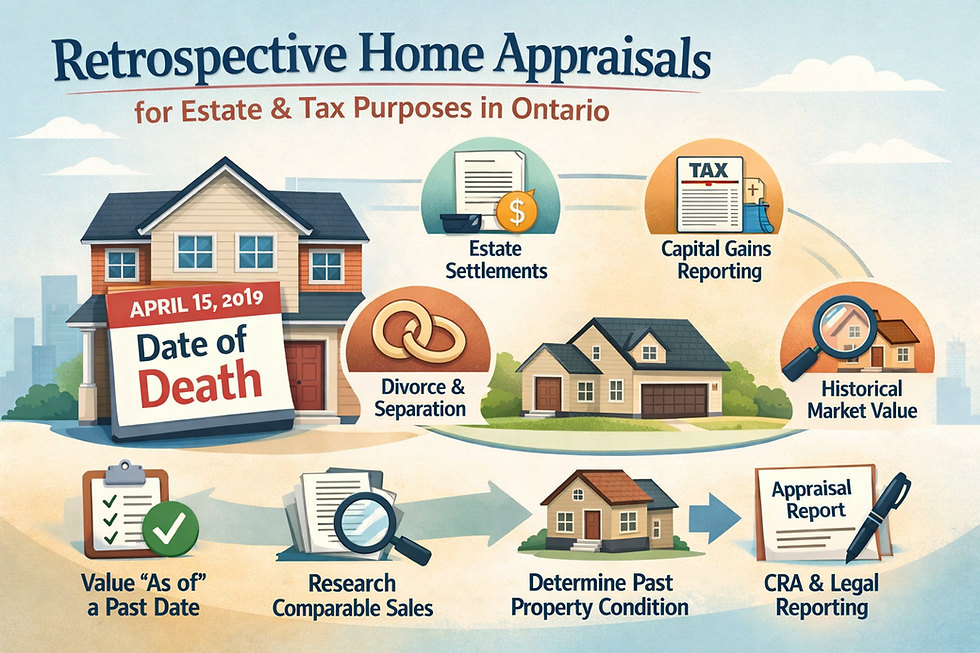

When someone passes away or an estate is being settled, one of the most common questions families, executors, and accountants face is: “What was the home worth on the date that matters?” In Ontario, that “date that matters” is often a past date—such as the date of death, the date of separation, or another legally significant date. That’s where a retrospective home appraisal comes in.

A retrospective appraisal provides a professional opinion of market value as of a prior effective date, supported by historical market evidence. These reports are commonly used for estate administration, capital gains reporting, CRA matters, equalization, and other tax-related needs.

Below is a practical guide to how retrospective appraisals work in Ontario, what they’re used for, and what information you’ll need to get one completed efficiently.

What Is a Retrospective Home Appraisal?

A retrospective appraisal is an appraisal completed today, but with a value opinion developed for a past date (called the effective date). The appraiser analyzes the real estate market as it existed at that time and relies on sales and listings that were relevant around the effective date—not today’s market.

For example:

A property might be inspected in December 2025

But the value might be required as of October 16, 2020 (effective date)

The inspection is used to document property characteristics, while the valuation is anchored to the historical market conditions that applied on the effective date.

Common Reasons for Retrospective Appraisals in Ontario

1) Estate Settlements and Probate Support

Executors often require a market value at the date of death to help:

allocate assets fairly among beneficiaries

support estate accounting and distributions

document decisions if beneficiaries later question value

Even when probate itself doesn’t always require a formal appraisal, a credible valuation can reduce disputes and improve transparency.

2) CRA and Tax Reporting (Capital Gains)

Retrospective appraisals are frequently used for capital gains purposes, especially when a property:

was not a principal residence for all years

was a rental or investment property

changed use (e.g., rental to personal use or vice versa)

was inherited and later sold

In these cases, establishing a defendable value at a specific past date can be important for calculating taxable gains accurately.

3) Date-of-Death Value for Inherited Property

If a beneficiary later sells an inherited home, the base value may relate to the value at the date of death (depending on the situation and tax reporting requirements). A retrospective appraisal can help support the starting point used for reporting.

4) Separation, Divorce, and Equalization Dates

Although not always “estate,” retrospective values are also commonly needed for:

date of separation

marriage date

litigation or settlement support

If you’re dealing with both estate and family law timelines, the effective date becomes critical.

5) Estate Disputes and Litigation Support

When there is disagreement among beneficiaries or family members about what a property was worth “back then,” a retrospective appraisal can provide:

market-based analysis

documented comparable sales

a clear explanation of assumptions and limitations

How a Retrospective Appraisal Works (In Plain Language)

A typical retrospective appraisal process includes:

Step 1: Confirm the Effective Date

The effective date might be:

date of death

date of transfer

date of separation

another legally relevant date

This date controls the valuation.

Step 2: Inspect the Property (If Possible)

Even though the value is retrospective, the appraiser may still do a current inspection to confirm:

layout and size

finishes and renovations

condition and quality

basement finish, bedrooms, bathrooms

overall utility and appeal

If access isn’t possible (for example, the property has been sold or is unsafe), the appraiser may rely on alternatives such as:

MLS history and photos (if available)

previous listings

municipal records

third-party documentation supplied by the client

Step 3: Reconstruct the Past Condition

This is a key part of retrospective work: determining what the home was like on the effective date.

If renovations occurred after the effective date, the appraiser needs to separate:

what existed then

what changed later

When information is limited, the report may include an Extraordinary Assumption, such as assuming the property’s condition and features were materially similar to what can be verified from reliable sources.

Step 4: Analyze Historical Market Evidence

The appraiser selects comparable sales that occurred:

close to the effective date (often within 3–6 months when possible)

in the same market area

with similar size, style, age, condition, and features

Adjustments are made for differences between the subject and the comparables, and the final conclusion is reconciled based on the most reliable indicators.

What Information You Should Gather (It Helps a Lot)

To get the strongest retrospective appraisal possible, provide any of the following that you have:

the exact effective date

any MLS listing history (old listings, photos, descriptions)

renovation timeline (what was done and when)

floor plans (if available)

property tax bills / MPAC details

survey (if relevant)

leases (if it was rented)

photos from around the effective date (even phone photos help)

any invoices or permits tied to upgrades

The more the past condition can be verified, the fewer assumptions are needed.

What Are “Extraordinary Assumptions” and Why Do They Matter?

A retrospective appraisal may include Extraordinary Assumptions when key facts about the past condition cannot be fully verified.

For example:

the appraiser may assume the kitchen and bathrooms were in similar condition to what is shown in an MLS listing from the effective date

the appraiser may assume no major structural changes occurred between the effective date and inspection date unless evidence suggests otherwise

These assumptions are disclosed so the reader understands what the value is based on, and what could affect it if the assumptions are later proven incorrect.

Does the Inspection Date Affect the Value?

The inspection date does not change the effective date. The value is still developed as of the retrospective date.

However, the inspection (or documentation) supports:

accurate property description

verification of characteristics

understanding of any changes over time

A well-written report clearly separates:

observed condition at inspection

assumed/verified condition at the effective date

value opinion as of the effective date

How Long Does a Retrospective Appraisal Take?

Retrospective assignments often take longer than a standard current-date appraisal because they require:

historical research

older sales verification

reconstruction of condition at the effective date

extra documentation review

If you’re under a deadline (accountant, lawyer, or court date), it helps to gather records up front.

Choosing the Right Appraiser in Ontario

For estate and tax-related retrospective appraisals, look for an appraiser who:

understands retrospective valuation methodology

writes clear narratives suitable for accountants and legal use

can explain assumptions and limiting conditions properly

follows professional standards (important in sensitive estate matters)

This isn’t the same as a quick “market estimate”—it’s a formal analysis that may be relied upon by third parties.

Frequently Asked Questions

Is a retrospective appraisal the same as a current appraisal?

No. A current appraisal values the property today. A retrospective appraisal values it on a past date, using historical market evidence.

Can you do a retrospective appraisal if the property was renovated after the effective date?

Yes, but the appraiser must identify what existed at the effective date and may need supporting documentation and/or assumptions.

What if no one has photos from the effective date?

The appraiser can sometimes use MLS archives, municipal records, and other documentation. If details can’t be verified, extraordinary assumptions may be required.

Is a retrospective appraisal useful if beneficiaries disagree?

Yes—because it creates an independent, market-supported opinion and a documented rationale, which often helps reduce conflict.

Final Thoughts: Why Retrospective Appraisals Matter

For estate and tax purposes, the question isn’t “what would it sell for today?” It’s “what was it worth then?” A retrospective appraisal provides a defendable, professional value opinion tied to a specific date—helping executors, families, and advisors make decisions with confidence and reduce the risk of future disputes.

Comments